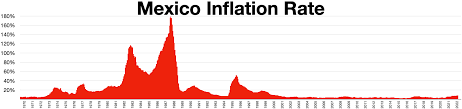

Mexico Inflation

In recent years, Mexico has grappled with the challenge of rising inflation, posing significant economic implications for the country and its citizens. Inflation, the persistent increase in the general price level of goods and services, has been a key concern for policymakers and economists alike. This article delves into the causes, effects, and the economic outlook of inflation in Mexico, shedding light on the complex dynamics at play.

Table of Contents

ToggleCauses of Inflation in Mexico:

- External Shocks: Mexico’s economy is intricately linked to global markets, and external factors can exert significant pressure on its inflation rate. Fluctuations in commodity prices, especially oil, impact the country’s fiscal health due to its dependence on oil exports. Consequently, any disruption in global markets can trigger inflationary pressures.

- Exchange Rate Movements: The value of the Mexican peso relative to other currencies plays a crucial role in inflation dynamics. A depreciating peso makes imports more expensive, contributing to higher overall prices. Mexico’s trade relations and exposure to international markets expose it to currency fluctuations, influencing inflation rates.

- Domestic Demand and Supply Factors: Inflation can also be fueled by domestic factors such as changes in demand and supply. Increased consumer spending, often spurred by credit expansion, can drive up prices. Additionally, supply-side constraints, such as inefficiencies in production and distribution, can limit the availability of goods, leading to higher prices.

Effects of Inflation in Mexico:

- Purchasing Power Erosion: One of the immediate effects of inflation is the erosion of purchasing power. As prices rise, the same amount of money buys fewer goods and services, impacting the standard of living for individuals and households. This phenomenon disproportionately affects low-income groups, exacerbating income inequality.

- Interest Rate Adjustments: Central banks often respond to inflation by adjusting interest rates. In Mexico, the Banco de México (Banxico) may raise interest rates to curb inflationary pressures. While this can help stabilize prices, it also has implications for borrowing costs, potentially slowing down economic growth.

- Uncertainty and Economic Instability: High and unpredictable inflation rates create uncertainty in the business environment. Businesses may be hesitant to invest or make long-term commitments, leading to economic instability. Foreign investors may also become cautious, affecting capital inflows and exchange rates.

- Impact on Savings and Investments: Inflation erodes the real value of savings and investments. Savers find that the purchasing power of their money diminishes over time, discouraging long-term saving. Investors face challenges in identifying profitable opportunities amidst the economic uncertainty caused by inflation.

Economic Outlook:

- Monetary Policy Measures: The Banco de México plays a pivotal role in managing inflation through monetary policy. The central bank uses tools such as interest rate adjustments and open market operations to influence the money supply and, consequently, inflation. Effective and timely policy measures are crucial for maintaining price stability.

- Structural Reforms: Addressing the root causes of inflation requires structural reforms. Mexico has made efforts to diversify its economy and reduce dependency on oil exports. Initiatives to enhance productivity, improve infrastructure, and streamline regulatory processes can contribute to long-term economic stability.

- International Trade Relations: Strengthening and diversifying international trade relations can mitigate the impact of external shocks on the Mexican economy. Developing resilient supply chains and fostering trade agreements with a diverse set of partners can enhance Mexico’s ability to navigate global economic uncertainties.

- Investment in Human Capital: Investing in education and workforce development can boost productivity and contribute to sustainable economic growth. A skilled and adaptable workforce is essential for innovation and competitiveness, mitigating inflationary pressures associated with inefficiencies in production.

Conclusion:

Inflation in Mexico is a multifaceted challenge with both domestic and global dimensions. Understanding its causes and effects is crucial for policymakers and citizens alike. As Mexico strives for economic stability and growth, implementing effective monetary policies, structural reforms, and fostering international trade relations will be pivotal in addressing the complex issue of inflation and ensuring a prosperous future for the nation.