In the ever-evolving landscape of financial markets, volatility plays a pivotal role in shaping investment strategies and risk management techniques. Volatility, often referred to as the magnitude of price fluctuations in a financial asset, has garnered significant attention from traders, investors, and analysts alike. Among the plethora of volatility metrics available, one that stands out is the VVIX, or the VIX of the VIX. In this article, we delve into the intricacies of VVIX, its significance, and its implications for traders and investors in navigating the complex world of financial markets.

Understanding VVIX:

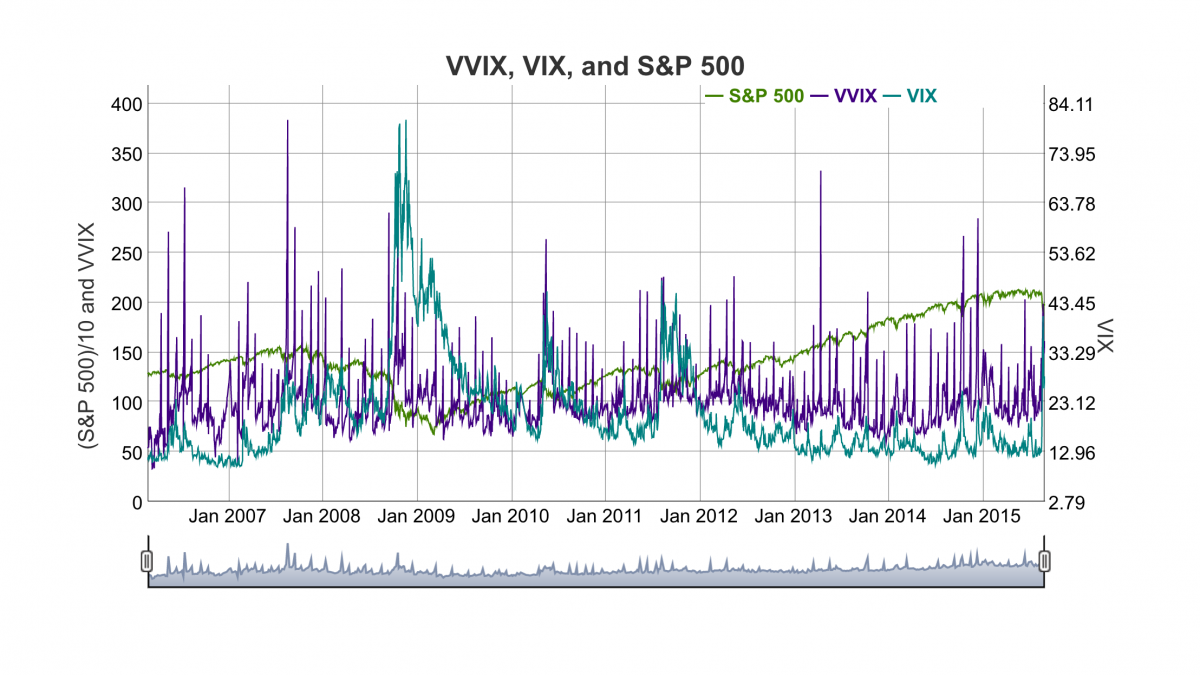

VVIX is a derivative of the VIX, also known as the CBOE Volatility Index. The VIX is a widely used measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. In essence, it represents investors’ consensus on the expected volatility in the market over the next 30 days. VVIX, on the other hand, measures the volatility of the VIX itself, providing insights into the market’s anticipation of volatility fluctuations in the VIX.

Importance of VVIX:

- Indicator of Market Sentiment: VVIX serves as a gauge of market sentiment regarding future volatility levels. A rising VVIX indicates increasing uncertainty and fear among investors, while a declining VVIX suggests diminishing anxiety and complacency in the market.

- Volatility of Volatility: By tracking the volatility of the VIX, traders gain valuable insights into the dynamics of market volatility. High levels of VVIX imply rapid and pronounced swings in the VIX, indicating turbulent market conditions ahead. Conversely, low VVIX values suggest relative stability and predictability in volatility levels.

- Risk Management Tool: VVIX aids traders and investors in assessing and managing risk exposure in their portfolios. A surge in VVIX may prompt investors to hedge their positions or adjust their risk profiles to mitigate potential losses during periods of heightened volatility.

- Contrarian Indicator: Like many sentiment indicators, VVIX can serve as a contrarian signal for market participants. Extreme readings of VVIX, either exceptionally high or low, often precede market reversals or turning points, offering valuable trading opportunities for savvy investors.

Utilizing VVIX in Trading Strategies:

- Trend Confirmation: Traders often use VVIX in conjunction with other technical indicators to confirm trends in the VIX. A rising VVIX alongside an uptick in the VIX may validate an ongoing uptrend in volatility, providing a signal to enter long volatility positions such as VIX futures or options.

- Option Pricing: VVIX plays a crucial role in option pricing models, particularly for VIX options. As VVIX reflects the volatility expectations of VIX options, traders can adjust their option pricing models accordingly to accurately value these derivatives.

- Volatility Arbitrage: Arbitrage strategies involving the VIX and its derivatives can benefit from monitoring VVIX. Discrepancies between VIX and VVIX levels may present arbitrage opportunities for traders to exploit, capitalizing on mispricings in the volatility complex.

- Risk Management: Incorporating VVIX into risk management frameworks allows traders to dynamically adjust their portfolio exposures in response to changing market conditions. By setting risk thresholds based on VVIX levels, traders can effectively manage their downside risk exposure and preserve capital during turbulent market environments.

Challenges and Considerations:

While VVIX provides valuable insights into volatility dynamics, it is not without its limitations and challenges. Like any other market indicator, VVIX is subject to noise, false signals, and interpretation biases, requiring careful analysis and validation. Moreover, VVIX may exhibit mean-reverting tendencies over time, complicating its use as a standalone trading signal.

Furthermore, VVIX’s reliance on VIX options data introduces liquidity and market depth considerations, particularly during periods of extreme market stress or dislocation. Traders should exercise caution when interpreting VVIX readings in illiquid or volatile market conditions to avoid erroneous conclusions.

Conclusion:

In the realm of volatility trading, VVIX stands out as a valuable metric for assessing market sentiment, managing risk, and identifying trading opportunities. By providing insights into the volatility of the VIX itself, VVIX offers a unique perspective on market dynamics and investor expectations. While challenges and limitations exist, incorporating VVIX into trading strategies can enhance decision-making processes and improve overall performance in navigating the complexities of financial markets. As volatility continues to play a central role in shaping market outcomes, understanding and leveraging VVIX remains essential for traders and investors seeking to stay ahead of the curve.